| Born | May 2, 1968 (age 52) Poughkeepsie, New York, US |

|---|---|

| Alma mater | United States Military Academy Wharton School of Business (MBA) |

| Occupation | Businessman |

| Known for | Former COO, Twitter |

| Title | CEO, SoFi (Social Finance, Inc) |

| Term | January 2018- |

| Spouse(s) | Kristin Noto |

| Children | 5 |

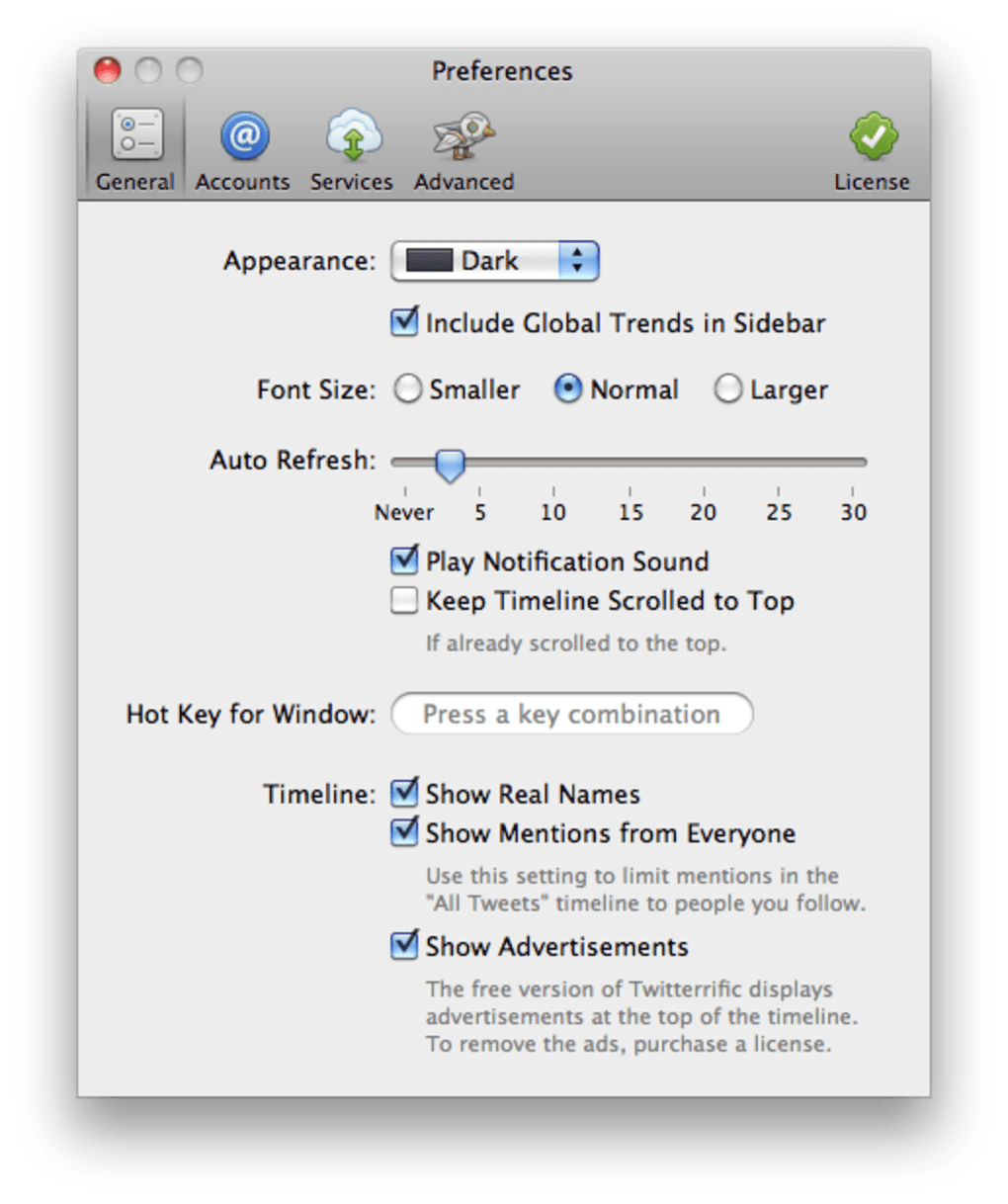

Twitterrific is the friendly, award-winning Twitter client that's beautiful to look at, easy to use and full of elegant features.

- Erik Day presents a comprehensive list of 100 of the best education hashtags for every social media-savvy educator out there.

- Anthony Noto (born 2 May 1968) is an American businessman, the CEO of SoFi, and the former COO of Twitter. Previously, he was a managing director at Goldman Sachs, CFO of the National Football League, COO of Twitter, and head of Twitter Ventures.

- Forum: iPhone Applications Get from here Applications for your iPhone.

Anthony Noto (born 2 May 1968) is an American businessman, the CEO of SoFi, and the former COO of Twitter.

Previously, he was a managing director at Goldman Sachs, CFO of the National Football League, COO of Twitter,[1] and head of Twitter Ventures.[2]

Early life and education[edit]

Anthony Noto is the son of Roseanne Niet (who died in 2015) and George Noto Sr. He has two siblings, George Noto and Thomas Noto. His brother Thomas died in 2018. He has 5 children with his wife, Kristin Noto. Noto graduated from Franklin D. Roosevelt High School in Hyde Park, New York. He attended the United States Military Academy at West Point, where he was a star linebacker on the football team, earning All-East and Academic All-American honors. In 1991, Noto was the highest-ranked mechanical engineering major in his graduating class.[3] After graduating from Army Ranger School at Fort Benning, Noto served as a Communications Officer with the 24th Infantry Division in Fort Stewart, Georgia.[3]

After serving in the military, Noto attended business school at the University of Chicago, while working at Kraft Foods as a brand manager, and later received an MBA from the Wharton School of Business in 1999.[3]

Career[edit]

Goldman Sachs and NFL[edit]

Noto joined Goldman Sachs in 1999 and was voted the top analyst by Institutional Investor magazine for research on the Internet industry.[4] Noto led the firm’s communications, media and entertainment research team at Goldman Sachs, and provided strategic direction and resource allocation for the group. He became a managing director in 2003, and a partner in 2004.[5]

On 24 February 2008, Noto took over the job of CFO for the National Football League, a position left vacant since former CFO, Barbara Kaczynski, left in February 2003.[4] Noto held the position until October 2010, but left just prior to the negotiations which led up to the 2011 lockout. He returned to Goldman Sachs in October 2010 as the co-head of Goldman’s global media group.[6] In 2013, Noto helped Goldman score one of the 'biggest tech prizes around' when the company won the role of lead underwriter for Twitter's initial public offering.[7] Noto would work as the main banker dealing with Twitter.[8]

Coatue and Twitter[edit]

In May 2014, Noto announced that he would be leaving Goldman Sachs to join the New York-based hedge fund Coatue Management LLC.[9] However, on 1 July 2014, Twitter CEO Dick Costolo announced that Noto would join Twitter as the company's CFO.[10] The two men built a good relationship the previous year when Noto managed Twitter's account while at Goldman Sachs.[8] In 2014, Noto received total compensation of $73 million.[11]

SoFi[edit]

On January 20, 2018, it was confirmed that Noto was leaving Twitter to become the CEO of SoFi (Social Finance, Inc.).[12][13]

References[edit]

- ^'Company Appoints Anthony Noto as COO'. Retrieved 9 November 2016.

- ^Hughes, Chase (March 27, 2015). 'Twitter's New Venture Capital Fund'. Retrieved March 27, 2015.[permanent dead link]

- ^ abcHyland, Tim (1 September 2009). 'The NFL's Money Man'. Wharton Magazine. Retrieved 30 November 2014.

- ^ abTaub, Stephen (16 January 2008). 'NFL Taps Goldman Partner as CFO'. CFO Magazine. Retrieved 30 November 2014.

- ^Rao, Leena (19 April 2013). 'Goldman Sachs' Anthony Noto Will Talk Technology Investments At Disrupt NY'. TechCrunch. Retrieved 30 November 2014.

- ^La Confora, Jason (20 September 2010). 'NFL will negotiate with players' union minus CFO Noto'. NFL.com. Retrieved 30 November 2014.

- ^Arash Massoudi; Tracy Alloway (September 13, 2013). 'Goldman Sachs wins prime role in Twitter IPO'. Financial Times. Retrieved 1 April 2014.

Goldman has now scored one of the biggest tech prizes around.

- ^ abGelles, David (3 October 2013). 'Goldman Banker With Year's Top Tech Quarry'. The New York Times. Retrieved 30 November 2014.

- ^Steinberg, Julie (13 May 2014). 'Top Goldman Sachs Tech Banker to Leave Firm'. The Wall Street Journal. Retrieved 30 November 2014.

- ^Molina, Brett (1 July 2014). 'Former-NFL CFO to help run Twitter IPO'. USA Today. Retrieved 30 November 2014.

- ^Lynn, Kerry (21 April 2015). 'Twitter's New CFO Anthony Noto Earned $73 Million In 2014'. IBT. Retrieved 21 April 2015.

- ^Rudegeair, Peter (January 20, 2018). 'SoFi Offers CEO Spot to Twitter Executive Anthony Noto'. The Wall Street Journal. The New York Times, New York City, United States. Retrieved January 21, 2018.

- ^'Top Twitter executive leaves to join SoFi'. 27 February 2018. Retrieved 27 February 2018 – via www.bbc.co.uk.

Twitterrific Push Notifications

Peter Fenton | |

| Born | July 1972 (age 48) |

|---|---|

| Nationality | American |

| Alma mater | Stanford University |

| Occupation | Venture Capitalist |

| Employer | General Partner at Benchmark |

Peter Fenton (born July 1972) is an American venture capitalist based in Silicon Valley. He is a general partner at Benchmark, a venture capital firm. Fenton has steadily worked his way up the Forbes Midas List of the 100 top technology investors, starting at no. 94 in 2007,[1] then rising to no. 62 in 2008[2] and no. 50 in 2009.[3] Fenton was ranked no. 4 when Forbes resumed publishing its Midas List in 2011 and was described as the “most productive venture capitalist on our list.”[4] In 2012, Fenton was ranked no. 5 on the Forbes Midas List[5] and was no. 2 in 2015.[6] He has been a perennial member on the Midas List since 2007.

Education and early career[edit]

Fenton graduated with a BA in philosophy and an MBA from Stanford University, where he was elected Phi Beta Kappa and an Arjay Miller Scholar, and spent seven years as a partner with Accel Partners. He was also an early employee at Virage[7] before joining Benchmark in 2006.[8]

Career[edit]

Benchmark[edit]

Fenton's investing style has been summarized as, “Wait until right before the company’s rising ‘adoption curve’ meets the declining ‘risk curve.’”[9] He served on the board of Twitter[9] and backed Twitter when it had only 25 employees.[4] He invested early in Yelp in 2006 and sits on its board.[9]

Noted for his expertise in open source technology, Fenton has invested in JBoss (acquired by Red Hat), SpringSource (acquired by VMware) and Zimbra,[10] which was later acquired by VMware.[11] The VMware acquisition occurred on the same day that Facebook acquired FriendFeed, another company in Fenton’s portfolio.[9] He led Benchmark's investments in Wily Technology (acquired by CA Technologies), Reactivity (acquired by Cisco), Coremetrics (acquired by IBM), Xensource (acquired by Citrix), Zimbra (acquired by Yahoo!),[5]Minted,[12]Quip (acquired by Salesforce),[13] and Polyvore (acquired by Yahoo).[14]

In addition to Twitter and Yelp, Fenton also serves on the boards of (in alphabetical order) Cockroach Labs, Digits,[15]Docker (formerly DotCloud), Elasticsearch, Engine Yard, Hortonworks, Lithium Technologies, New Relic, Optimizely, Revinate, Zendesk, and Zuora.[7][16][17][18][19][20][21][22] In December 2014, Fenton 'had one of the most unusual days in venture history' when two of his investments, Hortonworks and New Relic, went public the same day.[6] In February 2014, he was awarded the TechCrunch Crunchie for Venture Capitalist of the Year.[23]

References[edit]

- ^'The Midas List 2007'. Forbes. January 25, 2007. Retrieved May 12, 2011.CS1 maint: discouraged parameter (link)

- ^'The Midas List 2008'. Forbes. January 24, 2008. Retrieved May 12, 2011.CS1 maint: discouraged parameter (link)

- ^'The Midas List 2009'. Forbes. January 29, 2009. Retrieved May 12, 2011.CS1 maint: discouraged parameter (link)

- ^ ab'The Midas List 2011'. Forbes. April 6, 2011. Retrieved May 12, 2011.CS1 maint: discouraged parameter (link)

- ^ abGeron, Tomio (2 May 2012). 'The Midas List Tech's Top Investors'. Forbes. Retrieved 22 August 2012.CS1 maint: discouraged parameter (link)

- ^ ab'Peter Fenton'. Retrieved 2015-06-05.CS1 maint: discouraged parameter (link)

- ^ ab'Peter Fenton'. CrunchBase. TechCrunch. Retrieved 22 August 2012.CS1 maint: discouraged parameter (link)

- ^'The Midas List'. Forbes. January 29, 2009. Retrieved May 12, 2011.CS1 maint: discouraged parameter (link)

- ^ abcdCutler, Kim-Mai (10 August 2009). 'Benchmark's Peter Fenton nails both FriendFeed, SpringSource deals in one day'. Venture Beat. Retrieved 22 August 2012.CS1 maint: discouraged parameter (link)

- ^'Peter Fenton Has That Magic Open-Source Touch'. The Wall Street Journal. August 11, 2009. Retrieved May 12, 2011.CS1 maint: discouraged parameter (link)

- ^'VMware Gently Nudges Microsoft with a Zimbra'. The New York Times. January 13, 2010. Retrieved May 12, 2011.CS1 maint: discouraged parameter (link)

- ^'Benchmark, Marissa Mayer Put $5.5M In Stationery Design And Retail Site Minted'. TechCrunch.

- ^Gannes, Liz (30 July 2013). 'With $15M From Benchmark, Former Facebook CTO Bret Taylor's Quip Aims to Take Productivity Mobile'. All Things D. Retrieved 5 September 2013.CS1 maint: discouraged parameter (link)

- ^'Yahoo Paid Around $200 Million for Polyvore, a Search Engine for Fashion'. Recode. Retrieved 2018-06-08.

- ^Perez, Sarah (November 6, 2019). 'Stealth fintech startup Digits raises $10.5 million Series A from Benchmark and others'. TechCrunch.

- ^Williams, Alex (19 September 2013). 'DotCloud Pivots And Wins Big With Docker, The Cloud Service Now Part Of Red Hat OpenShift'. TechCrunch. Retrieved 7 January 2014.CS1 maint: discouraged parameter (link)

- ^Gannes, Liz (30 July 2013). 'With $15M From Benchmark, Former Facebook CTO Bret Taylor's Quip Aims to Take Productivity Mobile'. All Things D. Retrieved 7 January 2014.CS1 maint: discouraged parameter (link)

- ^Hoge, Patrick (25 July 2012). 'Hospitality social monitor Revinate gets $14.5 million'. San Francisco Business Times. Retrieved 7 January 2014.CS1 maint: discouraged parameter (link)

- ^Rao, Leena (9 November 2012). 'Big Data Search And Analytics Startup Elasticsearch Raises $10M From Benchmark'. TechCrunch. Retrieved 9 November 2012.CS1 maint: discouraged parameter (link)

- ^Metz, Cade. 'How Yahoo Spawned Hadoop, the Future of Big Data'. Enterprise. Wired. Retrieved 22 August 2012.CS1 maint: discouraged parameter (link)

- ^Ovide, Shira (Jun 4, 2015). 'CockroachDB Scampers Off With $6.3 Million to Tackle Database Shortcomings'. WSJ Blogs - Digits. Retrieved 2015-06-05.CS1 maint: discouraged parameter (link)

- ^Levy, Ari (5 September 2013). 'Twitter Backer Fenton Poised for IPO Barrage'. Bloomberg. Retrieved 10 September 2013.CS1 maint: discouraged parameter (link)

- ^https://techcrunch.com/2014/02/10/peter-fenton-crunchies/

Twitterrific For Pc

External links[edit]